Today’s Stocks, Bond, Gold & Bitcoin Trends, Friday, November 3, 2023

Navigating the Dynamic World of Finance: Today's Market Analysis

Persistence: The Key to Mastering the Markets

"I know I will win because I will never give up," a mantra that resonates deeply in the world of trading. Emphasizing the importance of dedicating 10 to 15 minutes each day to learning and engaging with the markets, this post underscores the notion that mastery comes with time and persistence. The journey to understanding the markets is an investment in itself, one that requires consistent effort and patience.

Today's Market Overview

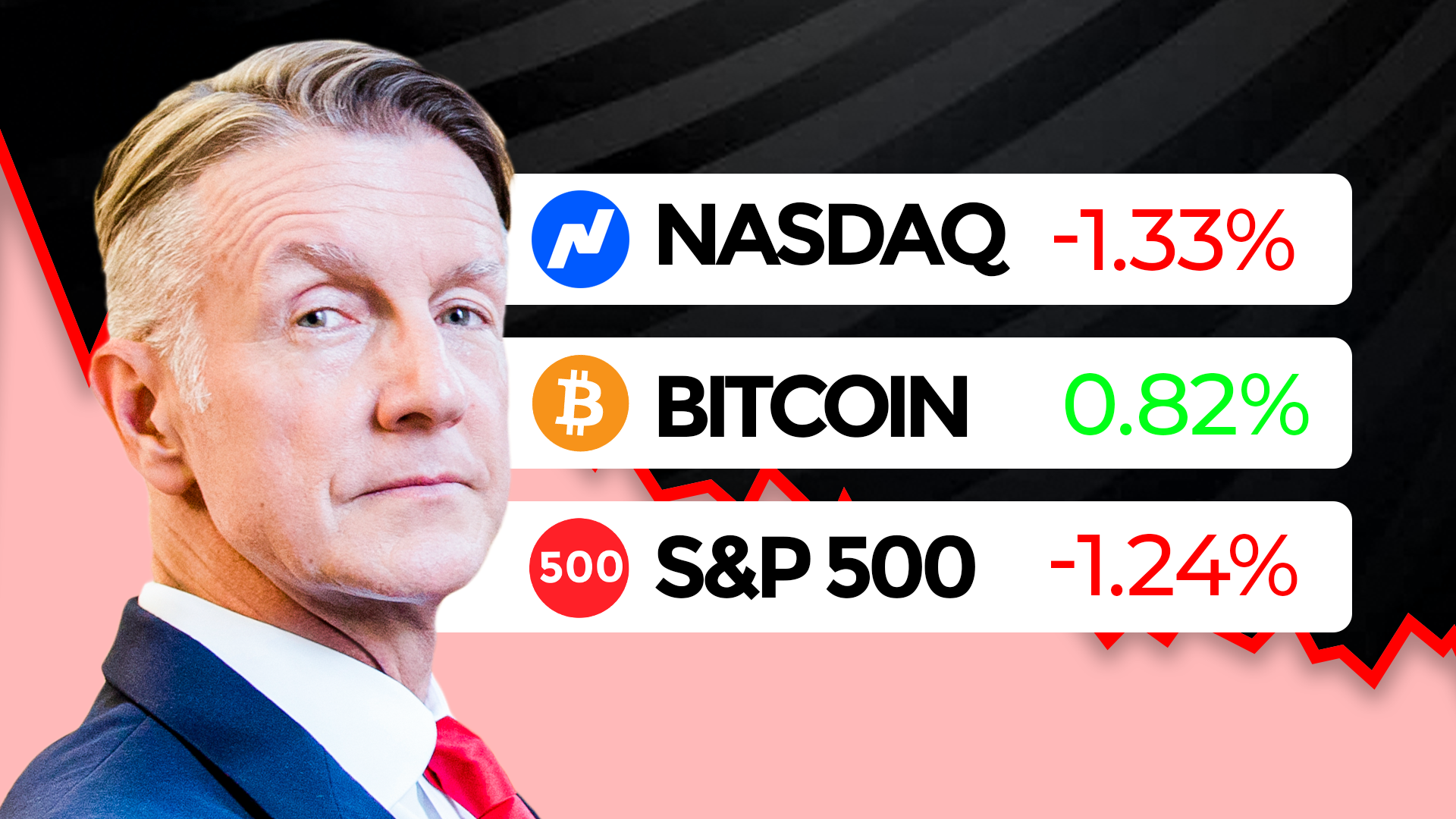

In a surprising turn of events amidst global tensions and economic uncertainties, including the war in Ukraine, Middle Eastern conflicts, and rising fuel prices, the markets showed a remarkable uptrend. The S&P and NASDAQ 100 both soared nearly 2%, signaling a significant shift in investor sentiment. Bonds followed suit with a 2.28% increase, while gold rose by 3%, and Bitcoin saw an 0.80% uptick.

Deep Dive into Market Charts

Analyzing the weekly charts, we observed a notable downward trend in the previous week, with current movements suggesting a potential reversal. The two-day charts for both the S&P and NASDAQ 100 indicated a strong upward trajectory, breaking through key trend lines. This shift presents an opportunity for traders to reassess their positions and potentially capitalize on the changing dynamics.

Strategic Decision Making in Trading

The blog post delves into the importance of setting parameters for trade exit strategies, emphasizing the need to justify one's decisions with clear reasoning. Whether it's taking profits or waiting for a trend reversal, the key lies in using a combination of candlestick patterns, trend lines, and profit and loss bands to make informed decisions.

Gold and Bitcoin: A Closer Look

Gold's slight uptick, despite a general market rise, warrants attention, suggesting a need for close monitoring in the coming days. Bitcoin, consistently showing resilience, continues its upward trajectory, further highlighting its role as a dynamic asset in the investment landscape.

Final Thoughts and Resources for Traders

The post concludes by encouraging traders to view every market movement as a learning experience. For those seeking more in-depth analysis and trading insights, the blog recommends joining their Patreon community, where they offer exclusive content including weekly vertical crossovers and a series on options trading.