Today’s Stocks, Bond, Gold & Bitcoin Trends, Thursday, November 2, 2023

Mastering Market Trends: A Daily Guide to Navigating Stocks, Bonds, Gold, and Bitcoin

Emphasizing Daily Learning in Trading

"Remember, if you don't prioritize your life, someone else will," Greg McGowan once said. This statement holds particularly true in the world of trading and investments. Spending 10 to 15 minutes daily to enhance your skills in charting and understanding market trends is crucial. Whether it’s practice trading or fractional trading, the key to mastery lies in consistent engagement with the markets.

Learning by Doing

As Mike Tyson famously said, everyone has a plan until they get punched in the face. This metaphor perfectly illustrates the difference between theoretical knowledge and practical experience. Reading books and consuming content is a great start, but the real learning begins when you’re actively participating in the markets, making trades, observing trends, and feeling the market's pulse.

Analyzing Market Trends

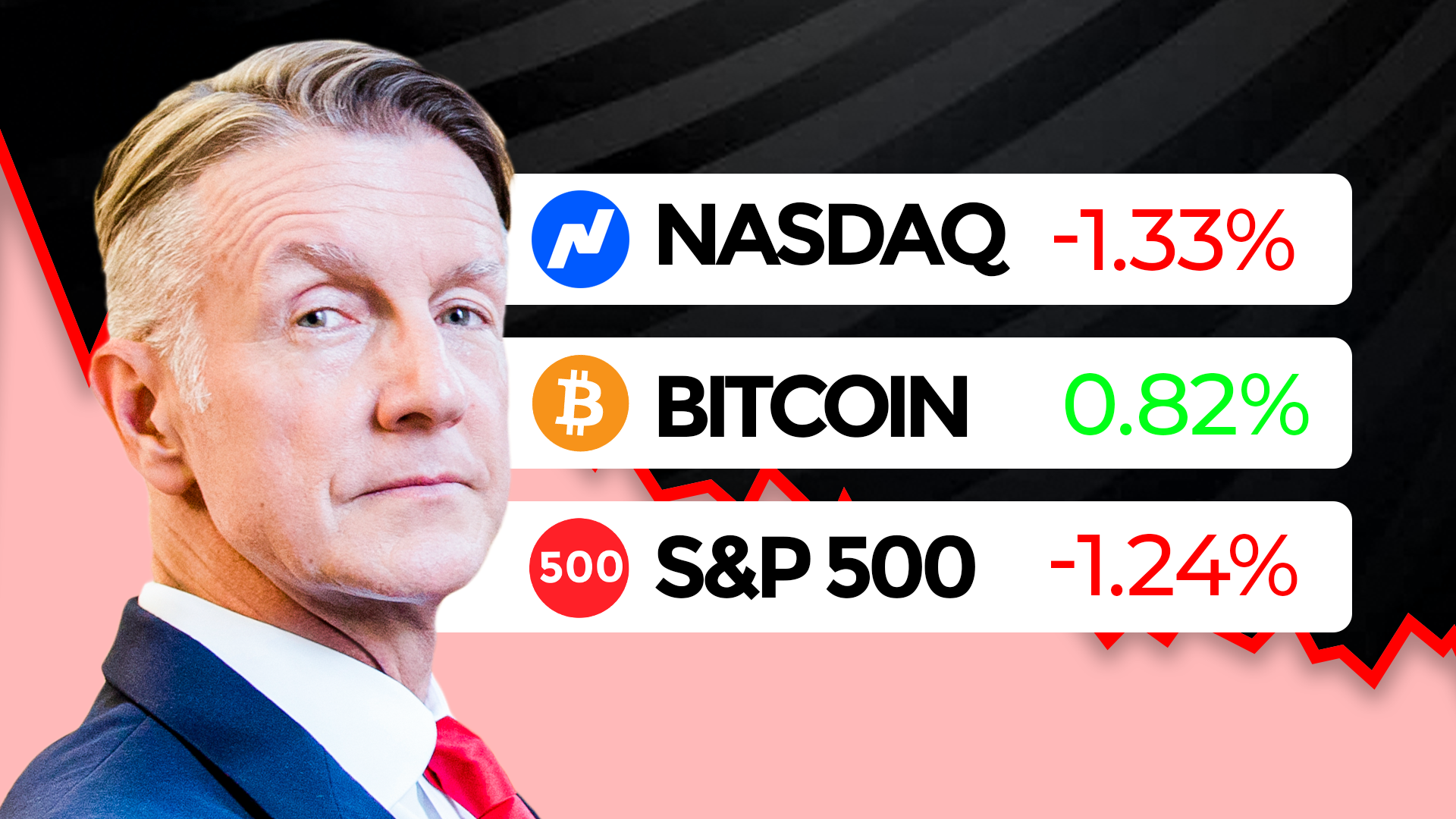

In today’s trading session, we noticed an interesting pattern. While the S&P 500 showed an increase of 1.07%, gold was the only sector that didn't see an uptick. The NASDAQ 100 also experienced a significant rise of 1.74%. However, it’s important to remember that all movements in the market are subject to underlying trends. The maxim “the trend is your friend until the end” serves as a critical reminder for traders to watch for signs of shifts in market momentum.

Bonds and Bitcoin Watch

Bonds have shown some interesting movements, breaking through certain trend lines, suggesting a need for close monitoring in the coming days. Bitcoin, on the other hand, showed a modest increase of 0.46%, trying to regain some of its lost momentum from the previous week. It’s a reminder of the volatile nature of cryptocurrencies and the need for vigilant observation.

Final Thoughts

Trading and investing are dynamic activities that require continuous learning and adaptation. As we navigate through these trends, it’s essential to remember the importance of daily practice, hands-on experience, and staying informed about market movements. With these tools at our disposal, we are better equipped to make informed decisions and capitalize on market opportunities.